Hey there, future homeowner! Ready to dive into the Bakersfield real estate market? I get it – buying your first home feels like trying to solve a Rubik’s cube blindfolded. But don’t sweat it. I’m here to walk you through every step of the process, from saving that first dollar to grabbing those shiny new house keys.

Why Bakersfield? Why Now?

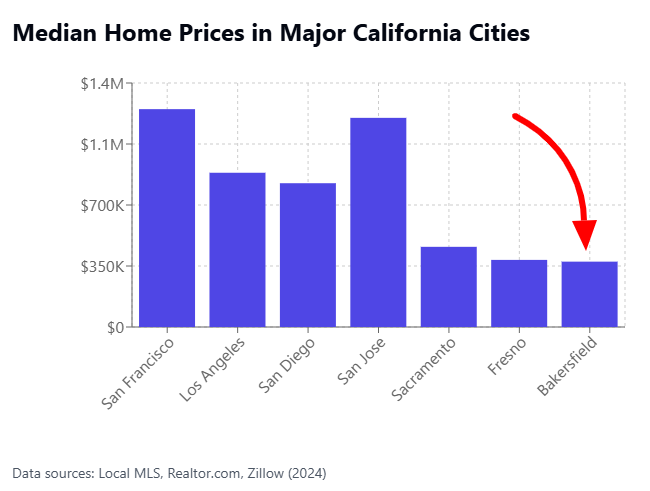

Just keeping it real – Bakersfield isn’t just about oil fields and country music (though we do those pretty well). This city’s got a lot going for it, especially for first-time homebuyers. According to recent data from the U.S. Census Bureau, Bakersfield’s population growth continues to outpace many California cities, indicating strong housing demand. With median home prices reported by Realtor.com sitting well below the California average, Bakersfield offers that sweet spot of opportunity many buyers are looking for.

The median home price in Bakersfield sits well below the California average, making it an attractive option for buyers looking to get more bang for their buck. Plus, with its strategic location just two hours from Los Angeles and four from the Bay Area, you get the benefits of California living without the coastal price tag.

What makes Bakersfield particularly appealing right now?

- Growing job market in healthcare, agriculture, and energy sectors

- New development projects bringing more amenities to the area

- Strong community feel with plenty of local events and activities

- Excellent schools in many neighborhoods

- Abundant outdoor recreation opportunities nearby, including the Kern River and the Sequoia National Forest.

If you’re planning to put down roots, Bakersfield’s steady appreciation rates and relatively stable market make it a solid investment choice. Unlike some California markets that see wild price swings, Bakersfield tends to experience more moderate, sustainable growth.

Your Step-by-Step Guide to Home Buying Success

1. Get Your Financial House in Order First

Before you start scrolling through those tempting home listings, let’s talk money. Think of this as the foundation of your home-buying journey – the stronger it is, the smoother everything else will go. Here’s what you need to tackle:

Assess Your Current Financial Situation

First things first. Let’s look at where you stand:

- Calculate your monthly income (be realistic and use your take-home pay)

- List all current debts (student loans, car payments, credit cards)

- Review your monthly expenses (the coffee runs count too!)

- Check your savings and investment accounts

- Pull your credit reports from all three bureaus

Start Building Your Savings Early

Think of saving for a home like training for a marathon – you can’t just wing it the day before. According to the Federal Reserve’s Survey of Consumer Finances, the median down payment for first-time homebuyers is about 7%. However, the minimum down payment can be as low as 3.5% unless you qualify for down payment assistance (which most people don’t). Here’s what you’ll need cash for:

- Minimum down paymentis typically 3.5% for FHA and conventional loans.

- Closing costs run from 2-5% of purchase price depending on the the type of loan and the amount of prepaid items like property taxes.

- Up front costs include about $500 for an appraisal and another $500 for inspections depending on the size of the home.

- Emergency fund (because that AC unit always knows the worst time to break). Be sure to get a home warranty to minimize major surprises.

- Moving expenses are typically $1,000-3,000 for local moves.

- Initial maintenance and repairs not paid by the seller.

- New furniture and appliances if you want a place to sit.

Smart Savings Strategies

The Consumer Financial Protection Bureau recommends these methods to boost your savings:

- Set up automatic transfers to a dedicated home savings account

- Use cash-back credit cards and save the rewards

- Consider a side hustle specifically for your home fund

- Look into down payment assistance programs

- Cut unnecessary subscriptions and redirect that money to savings

- Track your spending with a budgeting app

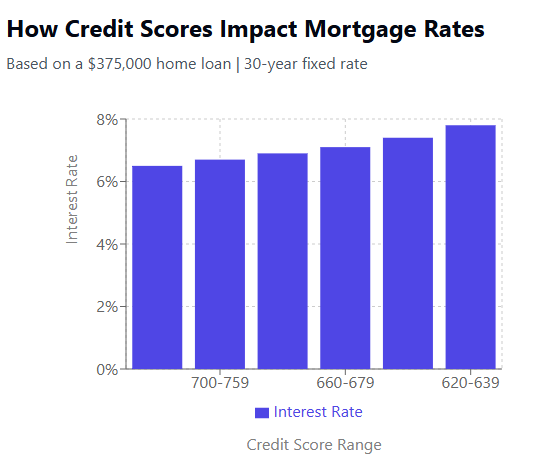

Master Your Credit Game

According to the Federal Trade Commission, more than 30% of credit reports contain errors that could mess with your FICO score. Get yours checked and fixed before a lender does. Better score = better interest rate = more money for that backyard BBQ setup you’ve been dreaming about.

Here’s your credit improvement playbook, backed by guidance from MyFICO:

- Review all three credit reports (Experian, TransUnion, Equifax)

- Dispute any errors you find (yes, even small ones matter)

- Pay down credit card balances to below 30% utilization

- Keep old credit accounts open to maintain length of credit history

- Avoid applying for new credit in the months before house hunting

- Set up automatic payments to avoid any late payments

- Consider becoming an authorized user on a responsible person’s credit card

Understanding Credit Score Impact

Here’s how your credit score affects your mortgage:

- 740+ : Best rates and terms

- 700-739: Good rates, slightly higher than best

- 660-699: Higher rates, may need larger down payment

- Below 660: Limited options, significantly higher rates

2. Team Up with the Right Professionals

Find Your Dream Team

Your success in the Bakersfield market largely depends on the professionals you choose to work with. Here’s who you need and why:

Local Lender

Look for someone who:

- Has extensive experience in the Bakersfield market

- Offers competitive rates and various loan programs

- Provides clear communication and quick responses

- Has good reviews from past clients

- Can explain loan options in plain English (or Spanish if applicable)

- Is willing to work with first-time homebuyer programs

Buyer’s Agent

Your Realtor should be:

- Exclusively representing you (no dual agency – you want someone 100% in your corner)

- Deeply familiar with Bakersfield neighborhoods and market trends

- Available when you need them (especially important in a fast-moving market)

- Patient with first-time buyers

- Strong negotiator with a good track record

- Well-connected in the local real estate community

Home Inspector

Worth every penny, trust me. Look for:

- Certification from recognized organizations (ASHI, InterNACHI)

- Specific experience with Bakersfield homes and common issues

- Willingness to let you attend the inspection

- Detailed reports with photos and clear explanations

- Knowledge of local building codes and requirements

Get Pre-approved, Not Just Pre-qualified

Think of pre-approval as your VIP pass in the home-buying world. It shows sellers you’re serious and gives you a clear budget to work with.

3. House Hunting Like a Pro

Know Your Must-Haves vs. Nice-to-Haves

- Location (proximity to work, schools, amenities)

- Size and layout

- Property condition

- Future resale potential

Research Bakersfield Neighborhoods

Each area has its own vibe, and according to data from NeighborhoodScout:

- Northwest: Newer developments, family-friendly, median home values around $450,000

- Southwest: Established neighborhoods, larger lots, strong appreciation rates

- Downtown: Historic charm, urban lifestyle, growing entertainment district

- East: Mix of new and established areas, diverse price points

The Bakersfield City School District provides detailed information about school boundaries and performance metrics to help you make an informed decision.

Local Market Insights

According to the Kern County Assessor’s Office, key market indicators show:

- Average days on market

- Price per square foot trends

- New construction rates

- Appreciation patterns by neighborhood

The California Association of REALTORS® reports that Bakersfield continues to be one of the most affordable major housing markets in California, with a higher percentage of first-time buyers able to qualify for a median-priced home compared to coastal cities.

4. Making an Offer That Stands Out

In Bakersfield’s market, you need to be strategic. Your Realtor should help you:

- Analyze comparable sales

- Understand current market conditions

- Structure an attractive offer

- Navigate negotiations

5. From Contract to Keys

Once your offer’s accepted, you’ll need to:

- Get a thorough home inspection

- Agree with the seller about repairs

- Review the appraisal

- Secure final loan approval

- Complete the final walkthrough

- Close the deal

Common Pitfalls to Avoid

Let’s keep it real – buying a home is complex, and even savvy buyers can stumble. Here’s your heads-up on the most common mistakes I see in the Bakersfield market (and how to avoid them):

1. The Money Mistakes

Draining Your Savings for the Down Payment

I get it. You want to put down as much as possible to lower your monthly payments. But emptying your bank account for a down payment is like going on a road trip with an empty gas tank. Here’s why:

- New homes often need unexpected repairs

- Moving costs can sneak up on you

- Property taxes and insurance might be higher than expected

- You still need an emergency fund for life’s curveballs

Solution: Keep at least 3-6 months of expenses in savings after your down payment.

Making Big Purchases During the Process

You wouldn’t believe how many deals I’ve seen fall apart because someone bought a new car right before closing. Here’s what to avoid until you’ve got the keys:

- Opening new credit cards

- Financing furniture or appliances

- Making large bank deposits without documentation

- Changing jobs. Wait until after closing!

2. The House-Hunting Hazards

Falling for the First House You See

It’s like dating – you need to see what’s out there before committing. Common rush-job mistakes:

- Not comparing enough properties

- Ignoring red flags because “it’s perfect otherwise”

- Missing out on better deals in different neighborhoods

- Skipping important research about the area

Overlooking Location Factors

Bakersfield has some unique considerations:

- Summer heat can make north-facing backyards more enjoyable

- Some areas have higher utility costs

- Some areas have higher property taxes in a Mello-Roos District.

- Agricultural areas may have seasonal odors or dust

- Future development plans could affect property values

3. The Inspection Issues

Skimping on Inspections

In Bakersfield’s hot market, some buyers waive inspections to make their offers more attractive. Big mistake under most situations. Here’s what you need:

- General home inspection

- Pest inspection (termites love our climate)

- HVAC inspection (crucial in our heat)

- Sewer line inspection for homes over 20 years old

Ignoring Minor Red Flags

Small issues can hint at bigger problems:

- Water stains might indicate roof leaks

- Cracks in walls could signal foundation issues

- Musty smells often mean water damage

- Fresh paint in isolated areas might be covering problems

- Uneven floors could indicate structural issues

4. The Negotiation No-Nos

Being Too Aggressive

Sure, everyone wants a deal, but in Bakersfield’s market:

- Low-ball offers often get ignored

- Demanding too many repairs can backfire

- Being inflexible on closing dates can lose you the house

- Nickel-and-diming on small items can sour the deal

Being Too Passive

On the flip side:

- Not asking for necessary repairs

- Accepting verbal promises (get everything in writing!)

- Ignoring red flags from the seller’s disclosure

- Not negotiating when the appraisal comes in low

5. The Closing Complications

Misunderstanding Closing Costs

First-time buyers often focus on the down payment and forget about:

- Title insurance

- Escrow fees

- Loan origination fees

- Prepaid property taxes and insurance

- Home warranty (optional but recommended)

Not Reading the Fine Print

Before signing those closing documents:

- Review every page

- Verify property taxes and insurance amounts

- Double-check interest rate and loan terms

- Confirm all seller repairs are completed

- Check that all contingencies are met

Quick Rules on Avoiding Pitfalls

Remember these three golden rules:

- Take Your Time: The Bakersfield market moves fast, but rushing leads to mistakes

- Trust But Verify: Always get professional inspections and documentation

- Keep Your Cool: Emotional decisions rarely lead to good investments

By knowing these common pitfalls, you’re already ahead of the game. Just take it step by step, lean on your professional team, and don’t be afraid to ask questions – even if you think they’re silly (trust me, I’ve heard them all!).

The Bottom Line

Buying a home in Bakersfield doesn’t have to be overwhelming. Take it one step at a time, lean on your professional team, and keep your eye on the prize. Before you know it, you’ll be firing up that housewarming BBQ in your very own backyard.

Ready for kick-off? The first step is reaching out to a local lender and Realtor who can guide you through the process. They’ll help you understand exactly where you stand and what your next move should be.

Call or text Jerry D to make your own history at 661-333-5161.

Remember: This guide is meant to give you a solid foundation, but real estate markets can change quickly. Call or text me for the most current advice and market conditions.